If you hired a contractor or freelancer and paid them more than $600 in a year directly, you have to send them a 1099-NEC.

If you don’t want to file your 1099s electronically through the IRS’s Information Returns Intake System (IRIS), you’ll need to print them out and mail them the old-fashioned way.

But you can't just download the PDF form and hit "Print" to get a paper copy. The IRS has very specific requirements about how to print 1099s.

Can you print 1099s on plain paper?

No — at least, not copy that you send to the IRS. If you send the IRS a 1099 that you’ve printed on plain paper, you’ll be charged a penalty, just as if you’d failed to file the form at all.

1099s get printed at least three times — sometimes four. These are called copies A, B, C, and 1, and here’s who gets them:

- Copy A: For the IRS

- Copy B: For the person you paid

- Copy C: For your own records

- Copy 1: For your state (if you live in a state that requires a copy — most do!)

1099 Copy A uses specific, red-inked paper that the IRS computers can scan. All Copy A forms must be printed on this paper. It’s not just a matter of using a color printer loaded with red.

For Copies B,C, and 1, however, feel free to use whatever paper you like.

No matter which copies you’re printing, it’s important to fill out your 1099s correctly before you start. Read on for a brief guide to getting it right, or skip ahead to the section on when to print and send your forms.

What to do before you print your 1099s

The first thing you’ll need to do is understand how 1099s work — after all, the last thing you want is to send unnecessary forms!

There are a few points to cover when preparing to file a 1099.

Step #1: Understand your filing obligations

You’ll need to issue 1099s-NECs to all independent contractors you’ve hired for your business, as long as:

- You paid at least $600 or more in a single year.

- You paid them in cash, check, or direct deposit

Note: It’s uncommon, but it’s possible you’ll have to issue a 1099-NEC to a contractor even if you paid them less than $600. This usually happens if your contractor didn’t give you their taxpayer ID number — or if they gave you the wrong one.

Remember: You can write off anything you pay a contractor. Keeper can scan your bank statements to automatically detect your business write-offs — including money sent to freelancers and independent contractors.

{upsell_block}

That way, you never miss an opportunity to save.

Do you need to issue 1099-Ks?

No. If you paid them with a credit card or a third-party payment app (like PayPal), or through a big work platform (like Fiverr), they’ll receive a 1099-K instead.

However, you don’t file the 1099-K yourself. That’s handled by the payment processor, so it’s one less thing you need to worry about! The payments you make through those platforms can still be written off.

Do you need to issue 1099-MISCs?

Probably not. These are only used for miscellaneous income, such as royalties, commercial rent, or lottery winnings. You wouldn’t issue a 1099-MISC form to a freelancer, for example.

Step #2: Have all your information easily available

When filling out a 1099, accuracy is key. To ensure you’re doing them correctly, you’ll need to keep good records of your contractors’ information. Here’s what you’ll need from each of them:

- Their tax ID numbers (SSNs, EINs, or ITINs)

- The total amount you paid them during the year

- Their legal names

- Their addresses

Get your contractor’s information with Form W-9

Your contractors should have already filled out a W-9 form and provided it to you when they started work. Giving them this form is one of the first administrative tasks you should complete after hiring them.

If you ever miss a W-9, be sure to get it as soon as possible. If you don’t get it by the first time you pay them, you’ll have to worry about backup withholding. (That means taking out 24% of what you pay them and depositing it with the IRS, plus filing Form 945 to report what you’re withholding.)

Step #3: Double-check that you’ve entered your numbers correctly

Never round your numbers on a 1099. Always enter the amount you paid someone down to the penny.

Remember, these forms are what the IRS goes by when making sure your contractors are reporting the right amount of income. Messing up the numbers you send will impact not only your own taxes, but the taxes of the people you’ve worked with throughout the year.

While you can amend a 1099, it’s better to get it right the first time. Why risk damaging all those business relationships with sloppy reporting.

When should you print and send your 1099s?

All 1099-NECs need to be sent (meaning, postmarked) to both the IRS and your contractor by January 31. You shouldn’t have any Copy As or Copy Bs in your office after that point.

Avoid penalties by sending your forms on time

If you don’t file a Form 1099 to the IRS by the deadline — or if you don’t provide it with a form in the correct, red-inked format — you’ll pay a penalty. The amount depends on how late the form is:

- $50 if you file within 30 days

- $100 if you file more than 30 days late, but before August 1

- $260 if you file on or after August 1

If you can’t file on time, you can request an extension by submitting Form 8809 to the IRS. However, you’ll stilll need to provide the 1099-NEC forms to your contractors by January 31.

{write_off_block}

Let the IRS know how many forms you’ll be sending

There’s one last form you should know about: Form 1096. This is the form you fill out to tell the IRS how many 1099 forms you’ll be sending in.

1096 must also be printed on official, red-inked forms. File it with the IRS by February 28.

We know: a form to tell someone you’ll be sending them more forms? But it actually helps the IRS see if it’s gotten all the information returns it was supposed to. (Plus, we all know the IRS loves redundancy.)

Since both copy A of your 1099s and Form 1096 require special paper, how do you get the right ones?

{email_capture}

Where to order printable 1099 forms

You can order printable 1099 and 1096 forms two ways:

- Directly from the IRS

- From office supply stores

Should you order 1099s from the IRS or an office supply store?

That depends on whether you’re looking to save money or get your form filing over with as quickly as possible.

- For the best value: Order from the IRS

- For speed and convenience: Order from an office supply store

Ordering from the IRS

If you order your forms directly from the IRS, they’re free. You can get 100 copies of each possible form this way.

On the other hand, they can take 10-14 business days — or more — to arrive.

Ordering from an office supply store

These stores sell 1099s by the pack. Here’s how much you can expect to pay:

- Office Depot: $7.99 for 75 forms

- Staples: $23.59 for 24 forms

- Target: $20.35 for 75 forms

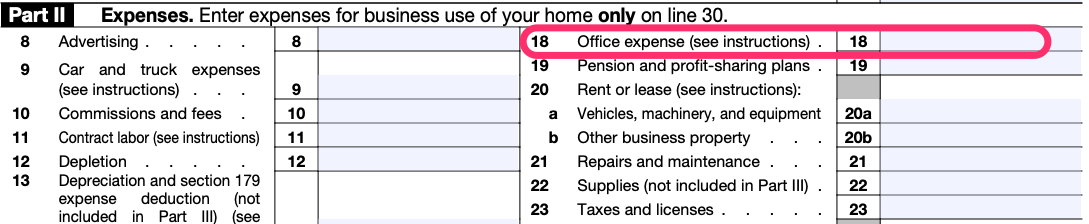

Note: These prices don’t always include shipping. But you can write off both the cost of the forms and anything you pay for shipping. Put them in Box 18 of your Schedule C, for "Office expense".

The benefit of ordering from a trusted office supply store: You can often get your forms shipped in a business day or two. You can also throw in envelopes or other office supplies that count as business expenses.

For Copy A (and your Form 1096), you have no choice but to order red-inked forms. But you can print your state, personal, and recipient copies with your regular Brother printer.

The best way to do this depends on what you’re printing from — whether it’s the IRS’s PDF, a spreadsheet, or a specific piece of software you use.

Keep scrolling for instructions for all these possible options, or skip ahead to the section that applies to you

How to print 1099s from a PDF

PDFs come with special code that lets them know where information gets filled out on a form. That means you can type right into the boxes on the form.

If you have an Adobe subscription, you can use Acrobat. But there’s an easier (and cheaper) way.

Filling in 1099s online

For most people, the easiest way to fill in PDFs is actually right in your web browser! Both Chrome and Firefox support “fillable” PDFs. So just open up the Form 1099-NEC from the IRS website, and start filling it in on your browser.

(Already downloaded the form? You can open it in a browser by right-clicking on the file and selecting “Open with…”)

Once you’ve filled out your information, you can print the document the same way you would any other file.

Since this method won’t work for Copy As, though, you can choose to save yourself some paper and skip printing the first two pages.

How to print 1099s from a spreadsheet

You can also edit the IRS’s 1099-NEC PDF by turning it into a spreadsheet.

This can be helpful for recordkeeping. Getting all the info from your 1099s into spreadsheet form can help you calculate how much you’re spending on contractors with a couple of clicks.

In addition, some tax programs let you import spreadsheets to quickly fill out multiple, similar 1099s.

Here’s how to turn a 1099 PDF into a spreadsheet.

Step #1. Convert your PDF into an XLS

If you have a subscription, you can convert the file from Adobe Acrobat. Otherwise, you’ll need to use one of these.

There are many available online for free (including a free Adobe service). Some work right in your browser, while others need to be downloaded:

- Adobe’s PDF to Excel service (Browser)

- PDFtoExcel.com (Browser)

- Tabula (Desktop)

Your converter will take the PDF and turn it into an XLS file, the file format spreadsheets are stored in.

Step #2. Edit your spreadsheet

You can either open this file with Excel or import it into Google Sheets to edit it.

Step #3. Look for mistakes in your XLS file

Be sure to compare your original PDF to the newly created spreadsheet. Look for places where the fields got misaligned.

You can adjust any formatting issues the same way you’d make changes to any spreadsheet. But be careful not to break any formulas or linked cells!

Step #3. Press print

Again, there’s no need to print Copy A, so skip the first two pages out of eight in the IRS’s PDF.

How to print 1099s from QuickBooks

All versions of QuickBooks can print 1099s, but each one has its own ways of doing so. Follow the instructions for your version — and always make sure it has the latest updates before you start!

The first thing you’ll need to do in any version of QuickBooks: create your 1099s. You can do this from the “Payroll” > “Contractors” section in QuickBooks online, or the “Vendors” > “1099 Forms” section of QuickBooks desktop.

Once you’ve filled out your 1099s, it’s time to print!

Printing from QuickBooks Online

Instead of having QuickBooks Online file your 1099s, you can choose the “I’ll file myself” option. From there:

- Select which type of form you’re printing: 1099-NEC, 1099-MISC, or 1096.

- Print a sample by clicking “Print sample on blank paper.” This will let you see if your printer will fill in those pre-printed red forms with all the information in the right boxes. (You don’t want the information getting printed in the wrong box!)

- Click “Yes, looks good!” if it prints correctly. If it doesn’t, click “No, it doesn’t line up,” and follow the instructions to realign your printer settings. When finished, click “Next.”Verify that the correct form is selected

- Choose which contractors you want to print 1099s for under “View selected 1099 contractors.”

- Make sure you have the right paper in your printer, and then click “Print on 1099 forms” or “Print on a 1096” form.

Printing from QuickBooks Desktop

Once you’ve created your 1099s, you’ll be presented with a screen that lets you choose a filing method. From there:

- Click “Print 1099-NEC” or “Print 1099-MISC”.Select which date range you’re looking for, then click “OK”.

- Select each contractor you want to print 1099s for.

- Click “Print 1099” or “Print 1096” if you only want that form.

- Make sure you’ve got the right paper in your printer.

- Verify your printer settings, and click “Print”.

Printing 1099s from Sage 50

Sage 50 will not print 1099s on blank paper — you’ll need the red-inked forms for Copy A, as well as pre-formatted black forms for the other copies.

Before you print your 1099s from Sage, you’ll need to make sure that all your vendor and 1099 settings are accurate. These are accessed through the “Maintain” menu, under either “Company Information” or the “Vendor Defaults” window. Remember to do this early, because all vendor 1099s must be printed before the end of the payroll year!

Once you’ve ensured your vendor information is correct, you can load your pre-formatted 1099 forms into your printer.

- Go to the “Reports and Forms” menu and select “Forms” > “Tax Forms”.

- Choose either 1099-INT (for interest payments) or 1099-MISC/NEC (for miscellaneous or contractor payments.)

- From that same window, click “Print and Preview”.

- Double-check that your payroll year is correct, and make any adjustments to the settings that you’ll need (such as adjusting limits, or selecting the type of payments to include in your 1099).

- Click “Print/Email”.

- From here you can choose your printer. If you’re using your computer’s default printer, simply click “OK”!

Printing 1099s from Patriot Accounting Software

Patriot lets you print on both pain paper and red-inked forms.

For either, you have to first go to the “Reports” screen from the sidebar menu and select “Contractor Forms” > “Create and View 1099/1096 forms”.

This screen will display all your current-year 1099s. To see previous years’, select the appropriate year from the dropdown menu. (Don’t see any reports? Make sure you create your 1099s first!) From here:

- Choose whether you’re printing your 1099-NECs or 1099-MISCs. Each will have a “Download options” button next to them.

- Select either “Formatted” (for perforated forms suitable for Copy Bs) and “Print-Friendly” (for standard paper and red-inked forms)

- Put the right type of paper in your printer, open the 1099 you just downloaded, and print it!

Note: For Form 1096, you’ll only need to print the last page of the downloaded PDF.

As you can see, printing all the different copies for your 1099s isn’t quite as straightforward as printing other kinds of documents. But with a little preparation, you can print and issue your 1099s with ease!

File complex taxes confidently

Upload your tax forms and Keeper will prep your return for you. 100% accuracy and maximum refund guaranteed. Plus, a tax pro reviews and signs every return.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email support@keepertax.com with your questions.

.png)